TODAY’S MORTGAGE RATE SUMMARY

HOW RATES MOVE:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up.

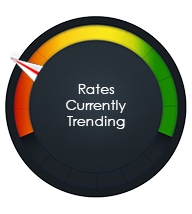

RATES CURRENTLY TRENDING: NEUTRAL

Mortgage rates are moving sideways so far today. The MBS market improved by +4 bps yesterday. This caused rates or fees to mostly move sideways for the day. The rates experienced moderate volatility yesterday.

TODAY’S RATE FORECAST: NEUTRAL

Jobs: The February Job Openings and Labor Turnover Survey (JOLTS) showed a very robust 6.882M unfilled jobs vs. est. of 6.600M.

Treasury Dump: We kick off three days of dumping our debt into the market place with our shorter-term 3-year note.

The Fed: The Federal Reserve Bank of New York will purchase $5.5B of FNMA 2.50 and 3.0 coupons at 9:50 am ET and then again at 2:20 pm ET.

Coronavirus: These are the headlines that the bond market is focusing on this morning.

- The US Cases now 370K, Deaths 11K

- Global cases now 1.4M, Deaths 76K

- Major League Baseball has discussed the possibility of playing all games in Arizona, with teams stationed in confined environments, according to multiple reports.

- A crew member aboard the floating hospital at NYC already has COVID-19.

- UK Prime Minister, who was self-quarantined, is now in the Intensive Care Unit in the hospital.

- The entire nation of Japan declares a State of Emergency, prepares a stimulus plan close to $1T

- House Speaker Pelosi tells Dems that they will push for a $1T plan.

TODAY’S POTENTIAL RATE VOLATILITY: AVERAGE

There’s nothing on the economic calendar today that can likely move rates. Volatility continues to decrease, and we expect the same for today.

BOTTOM LINE:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.

Source: TBWS